Intro to Tokenomics

As with all things crypto, it’s not fun unless you give it a cool name. Tokenomics is simply the catch-all phrase for understanding a project’s economics, which in crypto includes the math, the incentives and the distribution of the token or cryptocurrency over time. As developers create projects, they are essentially creating a new crypto economy and without strong tokenomics, users and investors alike will not believe in the longevity of the project.

Tokenomics is important to understand if one wishes to invest in crypto or a particular crypto project. Think of investing in a startup or the IPO of a company hitting the NYSE: a common thing people will look to read is the term sheet. We can think of the tokenomics of a crypto project as its crypto term sheet (of course, the project most likely has its own term sheet attached as well!).

Just like economics 101, it boils down to supply and demand. As with traditional money markets, investors will monitor the issuance of currency with supply data. Cryptocurrencies and tokens usually will have a set, algorithmically created, issuance schedule. Once launched, it becomes increasingly difficult, if not impossible, to change the tokenomics of a crypto or token, so it is important for developers to get it right.

For the supply side, we want to know how many of the cryptocurrency or token exists right now (circulating supply), how many can ever exist (the total supply capitalization), and at what rate, and how they are being released.

Let’s look at Bitcoin. Bitcoin was created with a simple supply model. Bitcoin will only ever have 21 million bitcoins at a rate that gets cut in half roughly every four years (every 210,000 blocks). Currently, over 19 million bitcoins already exist, or roughly just over 90% of the total supply, and are circulating. That means over the next ~120 years, only 2 million bitcoin will be released. Inflationary pressure due to new bitcoin being mined is not a serious concern because of the capped future supply. It mimics gold in this way because the inflation rate is predictable and decreasing as bitcoin’s inflationary rate will eventually be 0 once the supply is exhausted.

Another popular example, however, is Dogecoin. Dogecoin has no supply cap with a circulating supply of roughly 132 billion. It inflates roughly 3-4% each year. Some people claim this makes it more realistic in terms of a useable every day currency because it mimics current currencies.

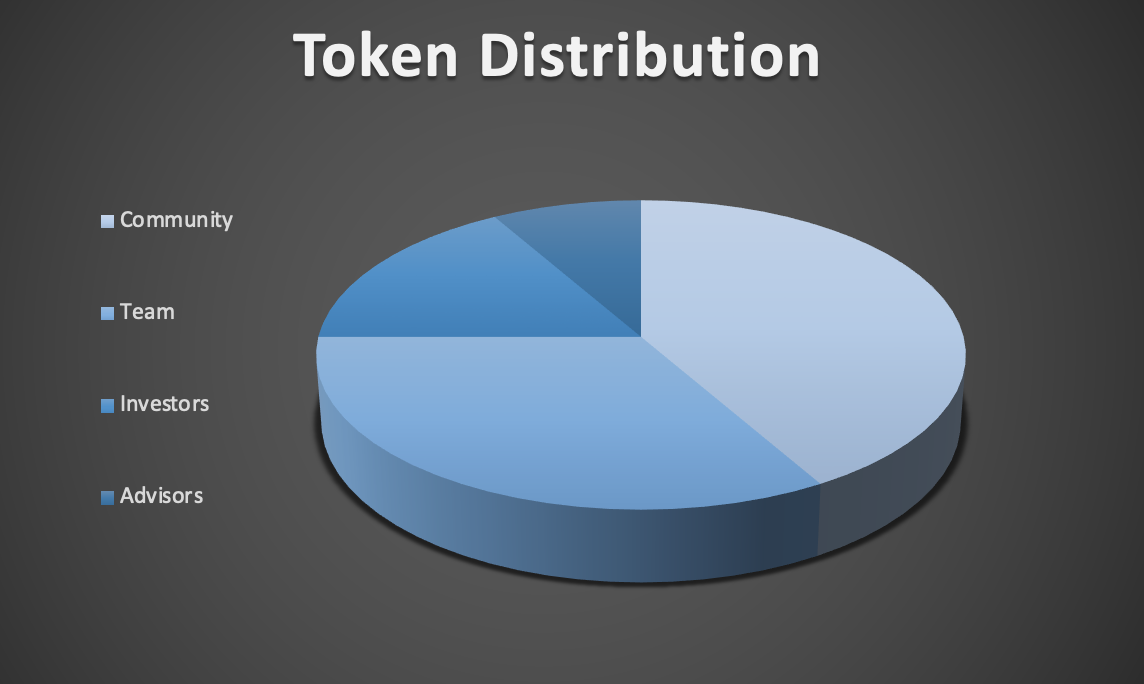

How these cryptocurrencies or tokens are emitted is also a highly important nuance to understand about a project. Crypto coins such as Bitcoin and Ether are mined by people who are incentivized to validate transactions on the decentralized network in return for more crypto coins. Tokens can be earned in yield from lending or staking in DeFi platforms or applications on many of the public blockchains. Investors also need to have a clear understanding of a project’s allocation and vesting period. The engineers, venture capitalists, investors and community that have helped bring the project to the public oftentimes all get a cut of the token or crypto before it is released to the public. Just like stock options, there may be vesting periods or large allocations to a few people who will have large portions of the circulating supply.

Understanding the demand and predicting the future demand can be much trickier in crypto. Some cryptocurrencies ‘burn’ tokens, or permanently remove them from circulation, to reduce the supply and keep demand steady. Some have burn schedules, or some protocols vote to burn some if the community believes the tokenomics requires it. Much of demand speculation revolves around the expected return on investment that an investor will receive by holding the token or crypto long.

Staking, or essentially locking your token up in its native network and removing it from circulation, offers rewards for helping secure the network. It works as incentivization for investors to hold their token long and participate in its value proposition. Governance is also a big value proposition for those who wish to see a project run in a certain way. Just like shares of a company allow you to vote, holding a native token gives you voting rights for that project. And just like any other project, the public opinion of the project also holds some merit. If the community around a project is positive and wishes to see it succeed, it will have a better chance of doing so. Not a guaranteed chance, but a better chance.

To some degree, a popular way of thinking about crypto involves thinking about game theory. Game theory as an economic concept assumes investors and traders are rational actors and will choose the optimal choice (mostly in terms of rewards). How can the tokenomics of a project push investors to participate and believe in their project in an economically sound way for both the investor and the project?